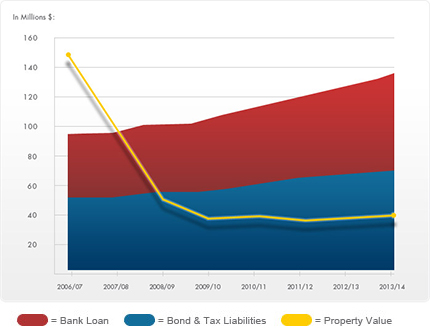

For example, when $50 million in bonds were sold in 2006 to build infrastructure for a planned 2,500 home development, the property appraised at $150 million. The project was also encumbered by a $45 million construction loan. Four years later, bond, tax and bank liabilities had increased to more than $100 million...and the property value had dropped to $40 million. The bond issue and bank loan defaulted in 2010, the project economics were ruined, and the entire development stalled putting the community and other stakeholders at an impasse.

With its team of seasoned partners in such situations, Common Bond has resolved such stalled projects through hands-on personal involvement, analysis and execution. We identify the complexities of the bonds, understand the real estate development (and associated interests) and determine:

Drawing on its successful track record, Common Bond then communicates, negotiates and aligns the interests of the stakeholders and effectively:

This expertise unlocks and de-levers stalled real estate developments to make them viable, creates new profitable economics for all parties, attracts participation by new investors and, thereby, rejuvenates otherwise failed projects.